Many people are considering alternative financial alternatives as the stock market remains volatile. Property investing can offer tax benefits and act as a hedge against inflation and market swings in comparison to stock investing.

Fortunately, there are many options for investing in real estate, and you may customize your strategy to meet your preferences, financial constraints, and way of life—all while building a dynamic portfolio.

Regardless of their age, gender, or location, customers of all demographics and age groups find real estate to be one of the most profitable investment possibilities. Property transactions are managed by real estate buyers, who also design contracts and supervise the buying and selling of properties. But for a range of fees, each provides slightly different services.

I’ve gathered some of the top real estate investment ideas from the best brokers in this article to aid with your decision-making.

1. Flexible Warehouses

Currently, commercial industrial real estate has some of the best returns available. Flex warehouses are becoming important as businesses try to solve complicated supply chain problems.

This kind of warehousing provides both storage space and office space. For businesses that need to store inventory and have a customer-facing space, it offers versatility.

2. Parking Garages

Finding a parking space might be difficult with more than 282 million cars on Australian highways. In a low-maintenance commercial venture, parking lots can either be operated by you or leased to a third party. The ebb and flow of demand can be captured via dynamic pricing to boost return on property investment.

3. Trusts That Invest in Real Estate

A fantastic place to begin in real estate investing is through real estate investment trusts or REITs. They give you the option to forego dealing with the property directly.

A real estate investment trust (REIT) investment can provide a steady stream of income. Investors can purchase and sell REITs on the market, just like they can with real estate equities.

4. Personal Storage

For many years, self-storage has performed better than other real estate segments. However, I still observe that a lot of people ignore self-storage. Even during downturns and recessions, these properties may provide reliable, strong returns.

When choosing this form of investment, don’t forget to consider the location strategically as it is essential. Due to oversaturation, investors have experienced some retraction in several markets.

5. Cellular Towers

Cell towers are an excellent investment option, but many people are unaware of it, especially those who are new to property investing. Over time, they can develop into a reliable source of income. Investors may offer a much-needed service and a long-term return to their assets as mobile coverage spreads into rural areas.

6. Retirement Communities

Another type of property that is frequently disregarded is senior living facilities. More people are looking for long-term living in senior-specific residences as the proportion of Australians aged 65 and older rises. Senior living facilities now have a fantastic investment opportunity because of this.

7. Parks For Mobile Homes

More and more homeowners are choosing mobile homes because they are adaptable and affordable. Additionally, mobile homeowners must park them someplace. Real estate buyers can rely on these sectors to provide a steady stream of passive income. Recent market developments have seen an increase in low rates, making this a perfect investment opportunity.

8. Business Multi-Family Units

Multifamily properties have five units or more, but residential multifamily properties only have two to four. This real estate investment option could perform exceptionally well in your portfolio due to the rise in units’ potential to generate a larger stream of income.

Do your research before investing in a business multifamily property. Consider checking the financial audit and market data for the property, deciding how the property will be managed, and reviewing service agreements for things like lawn maintenance and trash collection.

9. Coin Laundry Facilities

Financing six-figure properties right away is not necessarily necessary to get started in real estate. Coin-operated laundries, in my opinion, are an easy method for newcomers to invest in real estate.

One choice is to add to an existing home by converting an underutilized or underutilized space. You can start small with this choice and even loan or lease equipment to reduce expensive out-of-pocket expenses.

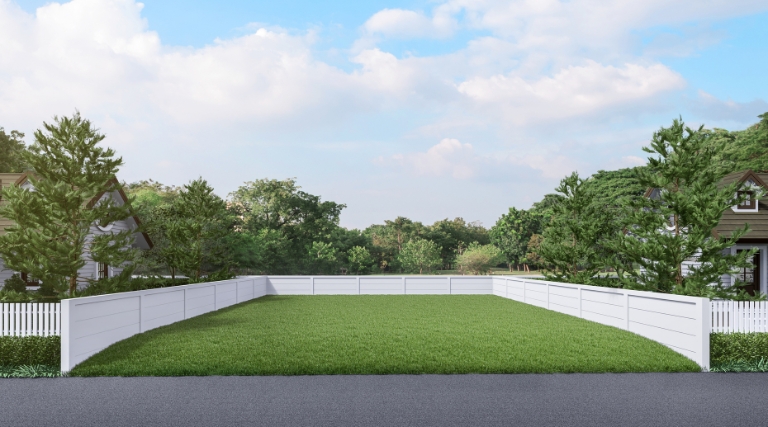

10. Vacant Land

Land is a component of every piece of real estate. Undeveloped land can be a good property investment opportunity occasionally though.

It can be a little intimidating to invest in undeveloped land if you’re not sure what to do next. To ensure that you get the most out of your investment in commercial land, many commercial brokerages offer consultancy services or joint ventures in property development.

Which choice is the best?

There are many real estate investment choices, so choosing one depends on the amount of money one is willing to put up, the kind of liquidity one wants, the regularity of cash flow, and risk tolerance.

Property ownership, leasing, and flipping demand large outlay and a solid background in the asset class. Flipping homes can result in great returns on investment, but it necessitates knowledge of the local real estate market, as well as upkeep expenses and experience.

The ETFs, on the other hand, provide high liquidity and cheap expenses, but a drawback is that there may not be monthly dividends and one may not get any profits until he or she sells the appreciated shares.

Even while REITs and fractional ownership of commercial real estate are relatively new to investors, they are both gaining popularity because they have finally made Commercial Real Estate (CRE) accessible to regular investors.

CRE is a pricey investment even if it has the potential to produce good returns. However, REITs and fractional ownership have lowered the barrier to entry in CRE, acting somewhat like real estate crowdfunding.

With fractional ownership, one can anticipate an annual rental yield of 8–10% and a 5%–10% yearly increase in the value of commercial real estate. The comparisons indicate that long-term profits on fractional ownership of commercial real estate can be larger and more consistent.